This year’s annual report finds that the extent of the forces driving the fracturing of the global wholesale and investment banking industry is yet to be fully understood. Global wholesale banks and market infrastructure providers face three major forces that will drive change in the industry:

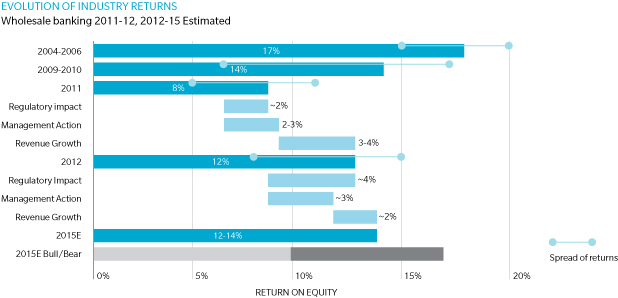

- Regulatory balkanization: the report anticipates a 2-3% drag on RoE as a result of the overlapping challenges of multi-jurisdiction, ring-fencing and national subsidiarisation. Diverging national regulatory agendas pose a major risk to the global banking model.

- OTC reform is accelerating: overall the report anticipates a less than 1% reduction in RoE for the industry as a result of OTC reform, which is less than the market anticipates. However, while the overall effect will be bounded, the value shifts will be dramatic. Client behavior will be impacted greatly – 45% of investors surveyed expected reduced volumes in OTC swaps in the next two years, and more than 60% of investors have not selected their clearing providers yet. The chronic shortage of collateral will generate new opportunities for some firms.

- The fixed cost challenge: while much progress has been made on restructuring financial resources, the industry is struggling with higher infrastructure and fixed costs. 2-3% points of additional RoE has to be found by firms finding greater economies of scope and scale, and solutions to make their cost structures more variable and mutual.

Evolution of Industry Returns

There is positive news on returns, which hit 12% in 2012 – lofty by recent standards. Despite the significant challenges, 12-14% RoE for the industry is in sight between 2014 and 2016. Our analysis shows that returns for the winners could be 3-4% points higher than the average and up to 8% points higher than the losers. It’s all dependent on banks addressing their three biggest challenges and taking advantage of new business opportunities.